Managing customer data across multiple channels often becomes chaotic as data flows in from web, mobile, and offline sources. You have data pouring in from websites, mobile apps, and offline sources. Your goal is to unify this information for better marketing, but high costs and complex integrations often get in the way. This is why many North American businesses actively research segment competitors to find a better fit. You might need a tool that supports compliance with laws like the CCPA or offers a more predictable cost structure than legacy platforms.

This guide explains the strengths and weaknesses of top data platforms. We will break down which tools offer better server-side tracking and identity resolution. You will learn which segment alternative aligns with your specific growth goals.

Key Takeaways

- While Segment offers deep integrations and enterprise-grade tooling, its MTU-based pricing, legacy architecture, and engineering-heavy setup create cost and complexity issues as businesses scale.

- Client-side tracking, third-party cookies, and black-box data storage lead to data loss, compliance risks, and poor attribution, especially under GDPR and CCPA.

- Newer segment alternatives prioritize server-side tracking, first-party identity resolution, and transparent data routing to maintain attribution and compliance.

- Choosing a CDP is a long-term decision about data ownership, cost predictability, and operational efficiency, not just integrations or features.

What is Segment?

Segment started as a simple data collection tool and grew into one of the most widely used Customer Data Platforms (CDPs) for digital marketing teams. At its core, Segment helps companies collect user data from websites, mobile apps, and web applications, then route that data to analytics, marketing, and advertising tools from a single place.

For marketers, Segment reduces the effort needed to add and manage multiple tracking tools. Instead of placing separate tags for every platform, teams send data once and distribute it wherever it's needed. This shift allows marketing teams to spend less time managing integrations and more time analyzing performance and customer behavior. Segment also supports data enrichment by combining customer information from CRMs, ad platforms, and other systems into unified profiles.

When evaluating segment competitors, Segment is most often recognized for simplifying integrations across a large destination ecosystem. It also supports data enrichment by combining information from multiple sources into unified customer profiles.

Who Uses Segment?

Before large acquisitions reshaped its direction, Segment primarily served engineers who needed reliable event tracking without heavy internal development work. Over time, Segment shifted focus toward marketers, offering easier ways to collect, merge, and activate customer data. Today, many marketing teams use Segment to build customer profiles, enrich audiences, and run campaigns across connected tools. Engineers originally valued Segment because it reduced the need to build and maintain custom tracking libraries and integrations. However, teams comparing segment competitors increasingly look for stronger privacy controls and clearer first-party data ownership models.

Modern marketers require tools that handle server-side tracking without constant engineering involvement or complex pipelines. Engineering teams also seek solutions that reduce maintenance overhead while supporting compliant, scalable data collection. As privacy rules tighten, businesses evaluating segment competitors prioritize platforms that balance marketer speed with technical reliability.

Understanding the user base is useful, but knowing the mechanics of the platform reveals why alternatives might be necessary.

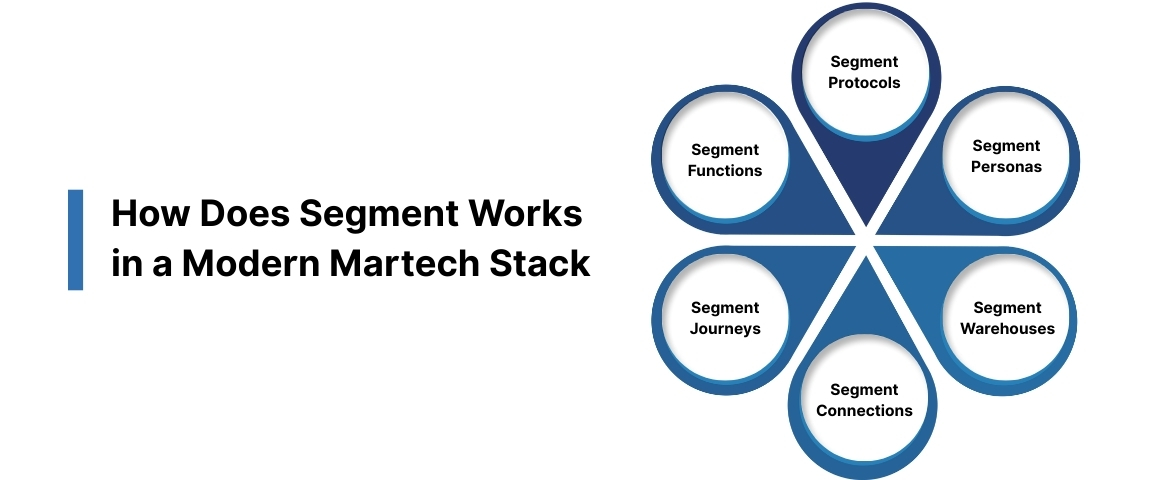

How Segment Works in a Modern Martech Stack

Many segment competitors approach customer data differently, but Segment structures its platform around modular, interconnected capabilities supporting enterprise-scale marketing operations. Within the broader segment alternatives category, Segment emphasizes centralized control over data collection, identity, transformation, and activation across marketing ecosystems.

Segment Protocols

Segment Protocols serves as the data ingestion layer, capturing customer events across web, mobile, server, and backend systems. It provides APIs, SDKs, and libraries that validate schemas, enforce data standards, and maintain event consistency across sources. Compared with other segment alternatives, Protocols emphasizes structured data governance early in the collection process.

Segment Personas

Segment Personas builds unified customer profiles by combining behavioral events, identifiers, and attributes into a single customer view. It supports audience creation using predefined and custom traits to power personalization across marketing and product tools. Within the segment cdp competitors space, Personas functions primarily as the profile and segmentation layer, with limited native activation compared to full experience platforms.

Segment Warehouses

Segment Warehouses enables teams to send collected customer data into cloud data warehouses like Snowflake or BigQuery. Although Segment retains a copy internally, this feature supports analytics, modeling, and reporting inside external warehouse environments. Many segment competitors offer warehouse syncing, but Segment tightly couples ingestion with downstream activation workflows.

Segment Connections

Segment Connections focuses on routing customer data from multiple sources to more than 300 integrated marketing and analytics destinations. This layer acts as a configurable data pipeline, allowing teams to manage destinations through a visual interface instead of custom engineering work. Among segment cdp competitors, Connections stands out for its breadth of integrations and support for both real-time and batch data delivery.

Segment Journeys

Segment Journeys enables visual orchestration of customer experiences using triggers, conditions, delays, and multi-channel actions. Marketers can design automated lifecycle flows across email, web, mobile, and messaging platforms without heavy development support. Among segment competitors, Journeys positions Segment closer to experience orchestration rather than pure data infrastructure.

Segment Functions

Segment Functions allows teams to run server-side JavaScript logic to transform or enrich event data before delivery. This capability supports custom business rules, formatting, and metric calculations directly within the data pipeline. Compared to lighter segment alternatives, Functions appeals more to teams with strong engineering involvement.

Segment delivers a broad, modular CDP designed for enterprises managing complex data flows and multi-tool marketing ecosystems. However, many segment competitors and modern segment alternatives position themselves around reducing operational overhead, privacy risk, and engineering dependency.

Now that you see the potential gaps in data collection, let’s review the specific platforms that fill them.

If Protocols and Functions feel like an engineering project, switch to a marketer-first setup. See how Ingest IQ keeps tagging stable while Event IQ turns events into usable journeys.

What Are the Alternatives to Segment?

Finding the right segment alternatives depends on your technical resources and budget. The market divides into legacy enterprise CDPs and modern, server-side data infrastructure. Here is how the top options stack up.

1. Ingest Labs (Ingest IQ & Event IQ)

Ingest Labs creates solutions specifically for the cookieless world. While Segment relies heavily on its legacy infrastructure, Ingest Labs focuses on server-side capabilities through Ingest IQ. This helps you capture a more complete set of customer events, even when ad blockers or browser restrictions limit client-side tracking.

Best For: Marketing teams and agencies that need privacy-aware tracking, stronger attribution, and minimal engineering overhead.

Key Features:

- Ingest ID: Assigns a persistent first-party identifier to visitors. This helps address attribution challenges introduced by browser restrictions.

- Ingest IQ: Moves tracking to the server. This can improve site performance and provide greater control over customer data.

- Event IQ: A customer intelligence platform that unifies data for real-time personalization.

If teams experience low match rates on advertising platforms, Ingest Labs supports first-party data activation to help improve match quality. The platform improves your Return on Ad Spend (ROAS) by feeding accurate, first-party data back to ad networks.

To learn how Ingest Labs supports first-party attribution and audience data workflows, contact us.

2. mParticle

mParticle is a direct segment competitor with a strong focus on mobile apps. It collects data from various touchpoints and syncs it to marketing stacks. It is popular among large consumer brands.

- Best For: Enterprise B2C brands with heavy mobile app usage.

- Pros: Strong identity resolution and enterprise-grade security features.

- Cons: Implementation is complex and usually requires a dedicated engineering team.

3. Tealium

Tealium is a veteran in the tag management and CDP space. It offers a highly configurable environment. It is one of the most common segment CDP competitors for regulated industries like healthcare and finance.

- Best For: Large enterprises requiring granular governance and HIPAA compliance.

- Pros: Extremely flexible data transformation and governance tools.

- Cons: The interface is dated and has a steep learning curve for non-technical marketers.

4. RudderStack

RudderStack positions itself as the "warehouse-native" segment alternative. Instead of storing data in their cloud, they dump it directly into your data warehouse (Snowflake, BigQuery).

- Best For: Engineering teams who want to build a CDP on top of their own data warehouse.

- Pros: You own the data storage; it does not persist on their servers.

- Cons: It is not marketer-friendly. You need SQL knowledge to get value out of it.

5. Adobe Real-Time CDP

Adobe is the heavyweight segment competitor for companies that have already invested in the Adobe Experience Cloud. It integrates tightly with Adobe Analytics and Target.

- Best For: Global corporations using the full Adobe suite.

- Pros: Seamless integration with other Adobe products.

- Cons: Extremely expensive and takes months to implement fully.

Listing these options highlights the variety available, but we must also examine the downsides of sticking with older models.

The Disadvantages of Legacy CDPs

Choosing a legacy segment competitor or sticking with the status quo brings distinct risks. Traditional CDPs were built for a different era of the internet.

- High cost of ownership: Most CDPs charge by "Monthly Tracked Users" (MTUs). If your traffic spikes or you track too many events, your bill explodes. This pricing model can make growth unpredictable and expensive as traffic scales. You end up deleting data just to stay within budget.

- Data Loss from Browser Restrictions: Legacy tools often rely on third-party cookies and client-side scripts. Safari and Firefox already restrict third-party cookies, and Chrome is gradually deprecating them. This means you lose visibility on a large chunk of your audience. A modern segment alternative must offer server-side tagging to bypass these limits.

- Compliance Nightmares: Moving data between regions (e.g., EU to US) is legally complex. Legacy platforms often store data in black-box servers. Transparent data orchestration is often required to meet internal privacy and governance expectations.

Legacy CDPs struggle to keep pace with privacy laws, browser changes, and the demand for accurate first-party data ownership. For teams evaluating segment competitors, modern segment alternatives increasingly prioritize server-side control, predictable costs, and compliance-ready data foundations.

Conclusion

Choosing between Segment competitors is no longer just a tooling decision; it is a strategic choice about data ownership, privacy readiness, and operational efficiency. It is a long-term call about data ownership, privacy readiness, and marketing efficiency. Segment still fits large enterprises with deep engineering resources, but its cost structure and legacy architecture create friction for many growing teams.

Modern segment alternatives focus on server-side tracking, first-party identity, and predictable pricing. These capabilities protect data accuracy as browsers restrict cookies and regulators tighten enforcement. For teams comparing segment cdp competitors, the right platform should reduce technical overhead while improving attribution, compliance, and real marketing outcomes.

Ultimately, the best segment alternative aligns with how your teams work today, not how CDPs worked a decade ago. Businesses that prioritize privacy-first infrastructure and clean first-party data position themselves to scale with confidence in a cookieless future.

Ready to future-proof your data strategy? Contact us to learn how Ingest ID and Event IQ support privacy-aware, first-party data workflows and attribution analysis.

FAQs

1. Is Segment considered a CDP?

Yes, Segment is a Customer Data Platform. It collects, cleans, and controls customer data. However, many segment competitors now offer similar features with better pricing or privacy controls.

2. Is Segment still a good choice for modern marketing teams?

Segment works well for large enterprises with strong engineering teams, but many teams now seek simpler, privacy-first segment alternatives.

3. Why are businesses switching to segment competitors?

Rising MTU-based costs, browser data loss, and complex implementations push teams to evaluate modern segment competitors.

4. Why are companies looking for a Segment alternative?

The main drivers are cost and privacy. Segments can become very expensive as you scale. Additionally, businesses need better server-side tools to comply with GDPR and CCPA.

5. What is the biggest limitation of legacy CDPs like Segment?

Legacy CDPs rely heavily on client-side tracking, which reduces data accuracy in cookieless browser environments.

6. How do segment alternatives handle privacy compliance better?

Modern segment alternatives emphasize server-side tracking and transparent data routing to support GDPR and CCPA requirements.