Have you ever wondered how much a single customer can contribute to your business over time?

Understanding customer lifetime value (CLV) is essential for making informed marketing decisions and driving sustainable growth. In an era where data privacy and effective tag management are more important than ever, understanding your CLV can give you a significant edge over competitors.

Calculating CLV goes beyond just knowing your average purchase value. It involves analyzing customer behavior, retention rates, and the overall impact of your marketing strategies. By mastering this metric, you can allocate your resources more efficiently, personalize your marketing efforts, and ultimately increase your revenue. Whether you're diving into conversion funnels in digital marketing or exploring real-time data streaming, CLV provides a foundational metric that ties all these elements together.

In this blog post, we’ll walk you through the steps to calculate customer lifetime value, and highlight its significance in a cookieless tracking environment. By the end, you’ll have a clear roadmap to use CLV for optimizing your marketing strategies and driving long-term success.

Let's first understand what customer lifetime value is.

What is Customer Lifetime Value?

CLV is the total revenue a business can expect from a single customer account throughout the entire relationship. It’s a crucial metric that helps you understand how much each customer is worth to your business, guiding your marketing strategies and investment decisions.

Let’s imagine you run an e-commerce store. Knowing the CLV allows you to determine how much you can afford to spend on acquiring a new customer while still maintaining profitability. This insight is particularly valuable when optimizing your conversion funnels in digital marketing or refining your paid media campaigns.

A higher CLV indicates that your customers are satisfied, loyal, and likely to engage with your brand repeatedly.

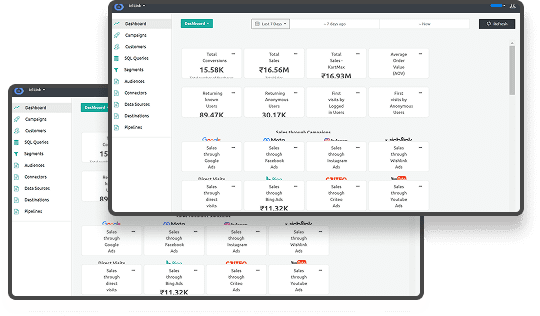

To achieve this, it's essential to leverage tools that enhance your data accuracy and compliance, such as server-side tagging offered by Ingest Labs. This ensures you’re collecting reliable data while respecting privacy regulations like GDPR and CCPA.

Now let’s focus on what CLV brings to your business.

Why CLV is Essential for Your Business?

Understanding customer lifetime value (CLV) gives you a clearer picture of how much each customer contributes to your business over time. Here’s why CLV is a must-know metric for growth:

- Informs Marketing Spend: CLV guides your customer acquisition budget to ensure profitable returns.

- Boosts Customer Retention: Recognize high-value customers and implement strategies to keep them loyal.

- Improves Resource Allocation: Focus resources on channels that attract valuable, long-term customers.

- Enhances Personalization: Craft campaigns that resonate with high-value segments, driving better engagement.

- Supports Long-Term Growth: With CLV insights, you can plan for sustained, profitable growth.

By using CLV, you make data-driven decisions that align with your business goals and strengthen your customer relationships.

Now let’s see about the applications of CLV.

Applications of CLV

Understanding and calculating CLV opens up numerous opportunities to enhance your business strategies. Here are some key applications:

- Marketing Budget Allocation

- Optimize Spend: Allocate more resources to acquiring high-value customers, ensuring maximum return on investment. By identifying segments with higher CLV, you can focus your paid media campaigns on channels that attract these valuable customers.

- Prioritize Channels: Use CLV to determine which marketing channels deliver the best long-term value, allowing you to invest wisely and reduce wasted spend.

- Personalized Marketing

- Campaigns: Use CLV insights to craft personalized marketing messages and offers that resonate with different customer segments. This enhances customer engagement and fosters loyalty.

- Dynamic Content: Implement personalized content strategies based on CLV data to deliver the right message at the right time, increasing the likelihood of repeat purchases.

- Product Development

- Focus on High-Value Products: Identify which products or services generate the highest CLV and prioritize their development and promotion. This ensures that your offerings align with what your most valuable customers seek.

- Innovate Based on Insights: Use CLV data to understand customer preferences and pain points, driving innovation that meets their needs and enhances their lifetime value.

- Customer Retention Strategies

- Enhance Retention Programs: Develop programs aimed at increasing customer satisfaction and retention, directly boosting CLV. Strategies might include loyalty programs, exclusive offers, and exceptional customer service.

- Predict and Prevent Churn: Utilize predictive analytics to identify customers at risk of leaving and implement proactive measures to retain them, thereby maintaining or increasing their CLV.

- Pricing Strategies

- Value-Based Pricing: Adjust your pricing strategies based on the perceived value from high CLV customers. This can help maximize profitability while ensuring that your pricing remains competitive.

- Tiered Pricing Models: Implement tiered pricing structures that cater to different customer segments, allowing you to capture more value from customers with higher CLV.

- Sales Strategy Optimization

- Targeted Sales Efforts: Focus your sales efforts on acquiring and nurturing relationships with customers who have the potential for higher CLV. This ensures that your sales team is working efficiently towards profitable outcomes.

- Cross-Selling and Upselling: Use CLV data to identify opportunities for cross-selling and upselling, increasing the overall value derived from each customer.

- Optimizing Tag Management and Data Collection

- Enhanced Data Accuracy: Use tools like server-side tagging to collect precise data, ensuring your CLV calculations are based on reliable information.

- Compliance and Privacy: Ensure that your data collection methods comply with regulations like GDPR and CCPA, maintaining trust and transparency with your customers.

- Improving Core Web Vitals and User Experience

- Optimize Website Performance: Use CLV data to prioritize website improvements that enhance the user experience for your most valuable customers, leading to higher satisfaction and increased CLV.

By applying these example calculations and using the diverse applications of CLV, you can effectively drive your business growth and enhance your digital marketing efforts.

Now that you have a basic understanding of CLV, it’s essential to examine key considerations that can impact the accuracy and relevance of your CLV calculations.

Considerations for CLV Calculation

When calculating customer lifetime value, several factors must be considered to ensure accuracy and relevance:

- Data Accuracy:

- Reliable data is the foundation of accurate CLV calculations. Utilizing tools like server-side tagging from Ingest Labs ensures that your data collection is precise and compliant with GDPR and CCPA.

- Customer Segmentation:

- Different customer segments may exhibit varying behaviors and values. Segmenting your customers allows for more customized and effective marketing strategies, enhancing overall CLV.

- Retention Rates:

- High retention rates typically lead to higher CLV. Implementing strategies to improve customer retention can significantly impact your CLV.

- Churn Rate:

- Understanding why customers leave helps in developing strategies to reduce churn, thereby increasing CLV. Tools like tag monitoring and alerts can help identify and address issues promptly.

- Economic Factors:

- External economic conditions can influence customer spending and behavior. Staying informed about market trends ensures that your CLV calculations remain relevant.

- Marketing Attribution Models:

- Choosing the right attribution model, such as multi-touch attribution, helps in accurately assigning credit to various marketing efforts, enhancing the precision of your CLV calculations.

By considering these factors, you can refine your CLV calculations, making them more accurate and actionable. This comprehensive approach ensures that you can effectively use CLV to drive your digital marketing strategies and achieve long-term business success.

Moving on, let's examine the basic formulas used to calculate this metric.

Basic Formulas for Calculating CLV

Calculating customer lifetime value (CLV) can initially seem daunting, but understanding the basic formulas makes it manageable. The simplest way to calculate CLV is by using the following formula:

CLV=Average Purchase Value×Average Purchase Frequency×Customer Lifespan

- Average Purchase Value: This is calculated by dividing your total revenue by the number of purchases over a specific period.

- Average Purchase Frequency: Determine how often the average customer makes a purchase within that period.

- Customer Lifespan: Estimate how long a customer purchases from your business.

For example, if your average purchase value is $50, customers buy twice a year, and they remain customers for 5 years, your CLV would be:

50×2×5=$500

This straightforward approach provides a foundational understanding of CLV, allowing you to make informed decisions about your paid media campaigns and conversion funnels.

However, as your business grows, you might need more advanced methods to capture the nuances of customer behavior. This leads us to explore more advanced CLV calculation methods.

Advanced CLV Calculation Methods

While the basic CLV formula offers a good starting point, more advanced methods can provide deeper insights. These methods consider customer acquisition costs, retention rates, and discount rates to offer a more precise CLV. Advanced CLV calculation Methods are:

- Cohort analysis

Cohort Analysis groups customers based on shared characteristics or behaviors within a specific timeframe. This approach helps in identifying trends and patterns, enabling you to customize your marketing strategies effectively. Additionally, integrating real-time analytics can enhance your ability to monitor and adjust your strategies based on current data.

- Predictive analytics

Another advanced technique involves using Predictive Analytics. By using tools like server-side tagging from Ingest Labs, you can collect and analyze vast amounts of data to predict future customer behaviors. This foresight allows you to proactively address potential churn and optimize your marketing efforts for maximum impact.

- Using Present Value in CLV Calculations

Incorporating present value (PV) into your CLV calculations adds another layer of precision by accounting for the time value of money. Essentially, it adjusts future cash flows to reflect their value in today's terms, providing a more accurate representation of CLV.

The formula for CLV using present value is:

CLV=∑((1+r)tCash Flowt)−Customer Acquisition Cost

- Cash Flowₜ: The net profit from a customer in period t.

- r: The discount rate reflects the cost of capital.

- t: The time period.

By applying present value, you account for the fact that money earned in the future is worth less than money earned today. This method is particularly useful when making long-term strategic decisions, such as expanding your integration capabilities or investing in performance optimization.

Using present value ensures that your CLV calculations provide a realistic estimate of a customer's worth, helping you to allocate your marketing budget more effectively and make informed decisions that drive sustainable growth.

Components of Advanced CLV Calculation

To capture the most accurate customer lifetime value (CLV), advanced methods incorporate several refined components. Here are the essential elements that provide a deeper, more strategic view of customer value:

- Retention Rate: The percentage of customers who continue doing business with you over a specific period. A high retention rate suggests strong loyalty and repeat purchases, positively impacting CLV.

- Churn Rate: This represents the rate at which customers leave or stop purchasing from you within a given timeframe.

- Customer Acquisition Cost (CAC): The total expense of acquiring a new customer, including marketing and sales costs. Subtracting CAC from CLV gives a net profitability figure, providing a realistic view of customer value after considering acquisition expenses.

- Discount Rate (r): Used in present value calculations, the discount rate accounts for the time value of money, reflecting the cost of capital or alternative investment opportunities.

- Gross Margin (GM): The profit margin after deducting the cost of goods sold (COGS) from total revenue. Gross margin ensures that CLV reflects actual profit rather than just revenue, offering a clearer picture of each customer’s profitability.

- Customer Cohorts: Segmented groups of customers based on shared characteristics (e.g., acquisition date, purchase behavior). Analyzing cohorts provides insight into specific customer segments, enabling more customized and targeted marketing approaches.

- Predictive Behavior Scores: Generated through predictive analytics, these scores estimate future customer actions, such as the likelihood of repurchasing or churn. Incorporating behavior predictions helps create proactive strategies to increase retention, adjust marketing efforts, and maximize CLV.

By focusing on these advanced components, businesses can calculate a CLV that better reflects the actual, long-term profitability of each customer. These elements support data-driven decisions and help optimize strategies for sustainable growth.

Implementing these advanced methods ensures that your CLV calculations are not only accurate but also actionable, helping you to refine your paid media campaigns and enhance overall marketing performance.

Let's look at some example calculations and explore their practical applications.

Example Calculations and Applications

To illustrate the practical application of customer lifetime value, let's walk through a couple of example calculations.

Example 1: Basic CLV Calculation

Suppose you run an online store with the following metrics:

- Average Purchase Value: $100

- Average Purchase Frequency: 3 times per year

- Customer Lifespan: 4 years

Using the basic CLV formula:

CLV=100×3×4=$1,200

This means each customer is expected to generate $1,200 in revenue over their lifetime with your business. Knowing this, you can decide how much to invest in acquiring new customers while ensuring profitability.

Example 2: Advanced CLV Calculation with Present Value

Consider a subscription-based service with these metrics:

- Monthly Subscription Fee: $50

- Average Customer Lifespan: 24 months

- Gross Margin: 80%

- Customer Acquisition Cost: $200

- Discount Rate: 5% annually

First, calculate the monthly gross profit:

Monthly Gross Profit=50×0.8=$40

Next, calculate the present value of the cash flows:

CLV=∑t=124(1+0.004167)t40−200≈$820

This advanced calculation provides a more accurate CLV by considering the time value of money and the cost of acquiring customers. With this information, you can make informed decisions about scaling your paid media campaigns and optimizing your marketing strategies.

Conclusion

Understanding and calculating customer lifetime value is a game-changer for any business. By mastering CLV, you gain invaluable insights into your customers' behaviors, preferences, and overall value to your business. This knowledge empowers you to make data-driven decisions, optimize your tag management, and enhance your data privacy and compliance efforts.

From the basic formulas to advanced calculation methods, incorporating present value, and understanding the key components, each step brings you closer to maximizing your marketing efficiency and profitability. Utilizing Ingest Labs' tools, such as server-side tagging and real-time data streaming, ensures that your CLV calculations are accurate, compliant, and actionable.

As you implement these strategies, remember to consider factors like data accuracy, customer segmentation, and retention rates to refine your CLV further. By doing so, you not only enhance your conversion funnels but also build stronger, more profitable relationships with your customers.

Ready to take your customer insights to the next level? Contact Ingest Labs today to learn how our solutions can help optimize your CLV, streamline data collection, and drive long-term success.