Spending too much to win customers? If you don't know your CAC (Customer Acquisition Cost), you might be throwing money away without even realizing it. Let's break down what CAC really means—and why it matters.

When evaluating the success of your marketing efforts, one of the most important metrics to consider is Customer Acquisition Cost (CAC). This metric helps businesses assess the cost of acquiring a new customer and is crucial for determining the sustainability and profitability of your marketing strategies. By understanding your CAC, you can make better decisions about where to allocate your marketing resources, how to optimize your sales strategies, and how to grow your customer base efficiently.

In this blog, we will explore the key concepts surrounding CAC, how to calculate it, why it’s important, and the factors that influence it.

To start, let's understand what Customer Acquisition Cost (CAC) is and why it’s important for your business.

What is CAC (Customer Acquisition Cost)?

Customer Acquisition Cost (CAC) is the total amount of money a business spends to acquire a new customer. This includes all marketing, advertising, and sales expenses that are necessary to bring in a new client. The formula for calculating CAC is simple:

CAC = Total Sales and Marketing Expenses/Number of New Customers Acquired

For instance, if your business spends $50,000 in marketing and sales and acquires 500 customers, your CAC is $100. This means that it costs you $100 to acquire each new customer.

Understanding CAC is essential because it helps businesses evaluate the effectiveness of their marketing and sales strategies. If CAC is too high relative to the revenue generated by each customer, businesses may need to rethink their marketing tactics and focus on improving customer retention.

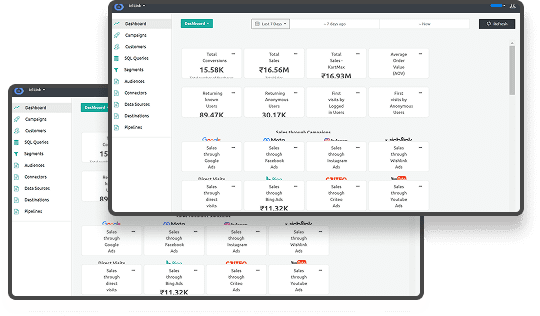

Businesses can utilize tools such as Ingest Labs to better track CAC. These tools help you manage customer data effectively while ensuring data privacy compliance (e.g., GDPR and CCPA). Ingest Labs offers secure, real-time data collection, which helps businesses track and analyze their CAC across different marketing channels, providing valuable insights into where to improve.

Explore more about: How Ethical Data Collection Builds Trust and Fuels Business Growth

Now that we know what CAC is, let’s look into why it's such an important metric for evaluating your marketing efforts.

Why is CAC Important?

Customer Acquisition Cost (CAC) is a key performance indicator (KPI) for businesses of all sizes because it helps measure the efficiency of your marketing and sales efforts. Here are some reasons why CAC is so important:

- Evaluating Marketing Efficiency:

By calculating CAC, businesses can assess how effectively they are acquiring customers. A high CAC means that marketing and sales efforts are inefficient, whereas a lower CAC signals that marketing spend is being used wisely. For example, Ingest Labs helps businesses track campaign performance in real-time, allowing you to monitor CAC and adjust your strategies accordingly. - Optimizing Resource Allocation:

With a clear understanding of CAC, businesses can allocate marketing resources more effectively. For instance, if your CAC is high, it may be time to reconsider certain marketing channels. Conversely, identifying low-cost channels can help boost overall profitability.

Consider using Ingest Labs to integrate with multiple marketing platforms to help you track spending and optimize your budget allocation.

Learn more about: Best Tools for Tracking Digital Properties

- Impact on Profitability:

If your CAC is greater than the lifetime value (CLTV) of a customer, your business could face profitability issues. Monitoring and reducing CAC ensures that businesses are acquiring customers at a cost that allows for sustainable growth. By tracking and optimizing CAC, businesses can improve long-term profitability. - Measuring Return on Investment (ROI):

CAC is directly related to ROI. If it costs you more to acquire a customer than you’re earning from that customer over their lifetime, your marketing strategies need to be adjusted. By reducing CAC through more effective marketing campaigns and improving customer loyalty, businesses can increase their ROI.

Explore more about Understanding and Optimizing Conversion Funnels in Digital Marketing

Next, let’s take a look at how to calculate CAC with a simple formula and the key factors to consider.

How to Calculate CAC

The formula for calculating CAC is straightforward. Here’s how to do it:

CAC = Total Sales and Marketing Expenses/Number of New Customers Acquired

For example, if your business spends $50,000 on marketing and sales and acquires 500 customers, the CAC would be:

CAC= 50,000/500

= 100

This means you are spending $100 to acquire each new customer.

However, it’s important to include all relevant expenses in your CAC calculation. This includes:

- Advertising costs (Google Ads, Facebook Ads, etc.)

- Salaries and commissions for the marketing and sales teams

- Cost of marketing tools and software

- Agency fees (if applicable)

Once you’ve calculated CAC, compare it with Customer Lifetime Value (CLTV). Ideally, CLTV should be much higher than CAC for your business to grow sustainably.

Learn more about: Understanding First-Party, Second-Party, and Third-Party Data: Strategies and Benefits

Now that you know how to calculate CAC, let’s explore the key factors that can impact this important metric.

Factors That Influence CAC

Several factors can impact CAC, and understanding these factors will help you reduce costs and improve the efficiency of your marketing campaigns. Below are the most significant factors:

1. Marketing Channels

Different marketing channels come with different costs. Paid channels, like social media ads or Google search ads, tend to have higher costs than organic channels such as content marketing or SEO. The choice of marketing channels will directly affect your CAC. Businesses need to track the performance of each channel and allocate resources based on their effectiveness.

Ingest Labs helps track customer interactions across channels, allowing you to optimize your marketing spend for maximum impact.

Learn more about: Top Google Tag Manager Alternatives in 2024

2. Sales Process Efficiency

An inefficient sales process can lead to a higher CAC because it takes longer to convert leads into paying customers. By optimizing your sales funnel, using marketing automation tools, and improving lead nurturing, you can reduce CAC and increase your conversion rates.

Ingest Labs offers tools to optimize this process, ensuring that customer data is effectively used at every stage of the journey.

3. Customer Retention Rate

A high customer retention rate can reduce CAC in the long run. Satisfied customers are more likely to refer new clients, which lowers the cost of acquiring additional customers. By focusing on improving customer loyalty and implementing referral programs, businesses can leverage existing customers to reduce CAC.

Ingest Labs can help you track customer satisfaction and identify opportunities to improve retention.

Learn more about: How Ethical Data Collection Builds Trust and Fuels Business Growth

4. Brand Awareness

The more familiar your brand is to potential customers, the lower your CAC. Strong brand recognition means that customers may come to you directly or through organic search, reducing the need for costly advertising campaigns.

Ingest Labs provides insights into how your customers engage with your brand across different touchpoints, helping you build a stronger, more recognizable brand.

5. Customer Segmentation

Segmentation allows you to target the right customers with the right message. By analyzing customer data, you can segment your audience based on various factors such as demographics, behaviors, and purchasing patterns. This ensures that your marketing efforts are focused on the most profitable customer groups, ultimately reducing CAC.

Explore more about: Understanding First-Party, Second-Party, and Third-Party Data: Strategies and Benefits

Understanding CAC is great, but it’s also important to see how it relates to Customer Lifetime Value (CLTV), so let’s break that down.

How CAC Relates to Customer Lifetime Value (CLTV)

CAC is often measured against Customer Lifetime Value (CLTV) to assess profitability. CLTV refers to the total revenue a customer will generate for your business over their entire relationship with your company. Ideally, CLTV should be much higher than CAC, as this means you’re making more money from your customers than it costs to acquire them.

For instance, if your CAC is $100, and your CLTV is $500, you’re in a good position because your customer generates five times the revenue it costs to acquire them. If your CAC is greater than your CLTV, it’s time to optimize your marketing strategies to lower CAC or increase CLTV by improving retention or upselling.

Explore more about: Understanding Multi-Touch vs. Last-Touch Attribution

Now, let’s explore some practical strategies you can use to lower your CAC and improve your overall profitability.

Reducing CAC and Improving Profitability

To improve profitability, businesses should focus on reducing CAC while maintaining or increasing CLTV. Here are some strategies to lower CAC:

1. Refine Your Targeting

The more specific your targeting, the more efficient your marketing efforts will be. Use customer data to segment your audience and create targeted campaigns that speak directly to their needs. This increases the chances of conversion, which lowers CAC.

2. Use Automation

Marketing automation can streamline many aspects of the customer journey, from lead generation to follow-up emails. By automating repetitive tasks, businesses can lower CAC while increasing the scale of their marketing efforts.

Learn more about: Best Tools for Tracking Digital Properties

3. Invest in Retargeting

Retargeting campaigns allow you to reach users who have already interacted with your brand but didn’t convert. Since they are familiar with your business, retargeting ads are more cost-effective and often lead to higher conversion rates.

4. Optimize Your Sales Funnel

An optimized sales funnel ensures that leads are nurtured effectively, reducing the time it takes to convert them. The faster you move leads through the funnel, the lower your CAC will be. Use CRM systems and marketing tools to track leads and ensure they receive the right messaging at each stage.

Learn more about: Track the Customer Journey Across Multiple Channels with Ingest Labs

How Ingest Labs Helps with CAC Optimization

Ingest Labs can help businesses reduce their CAC by offering real-time data tracking, advanced audience segmentation, and personalized marketing tools that improve targeting and conversion rates. Here’s how Ingest Labs supports the optimization of CAC:

- Real-Time Tracking:

Ingest Labs enables businesses to track and analyze customer behavior in real-time. This data allows you to quickly adjust your strategies to reduce CAC and increase conversions. - Advanced Segmentation:

With Ingest Labs, you can segment your audience based on behavior, demographics, and purchase history, enabling you to target high-value prospects effectively. This reduces wastage in your marketing spend and ensures that your advertising is more efficient. - Personalized Marketing:

Using Ingest Labs, you can create personalized ads and content that speak directly to your target audience, increasing engagement and conversion rates. Personalized experiences lead to higher ROI and lower CAC. - Seamless Integration with Marketing Platforms:

Ingest Labs integrates with various marketing platforms, ensuring that your CAC is managed holistically across all channels. From email marketing to paid ads, Ingest Labs helps you streamline your customer acquisition efforts and reduce the cost of customer acquisition.

For more insights on how Ingest Labs can help optimize your marketing campaigns, consider exploring Track the Customer Journey Across Multiple Channels with Ingest Labs.

Conclusion

Customer Acquisition Cost (CAC) is a crucial metric that provides valuable insights into your marketing and sales efficiency. By calculating CAC and understanding the factors that influence it, businesses can make informed decisions, optimize marketing strategies, and improve profitability.

Reducing CAC requires businesses to optimize targeting, improve customer retention, and streamline sales processes. By using tools like Ingest Labs, businesses can collect, track, and analyze customer data to make smarter marketing decisions and reduce acquisition costs.

Ready to Optimize your CAC and enhance your marketing strategies, contact us today and see how Ingest Labs can help streamline your customer acquisition efforts.