Many businesses struggle to determine the true cost of acquiring a customer, leading to wasted resources and ineffective marketing strategies. Understanding your customer acquisition cost is essential for optimizing your marketing efforts and ensuring sustainable growth.

Accurately calculating CAC involves more than just adding up your marketing expenses. It requires examining all the elements that contribute to attracting and converting customers, from targeted advertising to effective data management.

Knowing your CAC helps you allocate your marketing budget wisely and ensures your strategies are profitable and scalable. Whether you run a paid media campaign, manage an e-commerce store, or oversee an advertising agency, mastering this metric can significantly boost your growth.

Additionally, using advanced tag management and first-party data solutions ensures your data collection complies with regulations like GDPR and CCPA, building trust with your users.

In this blog, we'll explore how to calculate the true customer acquisition cost, Let’s uncover the essentials of CAC and improve your marketing effectiveness.

First let’s learn the basics about customer acquisition cost.

What is Customer Acquisition Cost (CAC)?

Customer Acquisition Cost (CAC) represents a business's total expenses to acquire a new customer. This metric encompasses all marketing and sales costs, including advertising spend, salaries, software tools, and other expenses directly related to attracting and converting customers. Understanding your CAC clearly shows how much you're investing to grow your customer base.

For instance, if your company spends $20,000 on marketing and sales monthly and acquires 200 new customers, your CAC would be $100. This straightforward calculation helps you evaluate the efficiency of your marketing strategies and make informed decisions about budget allocation.

Accurately determining your CAC is the first step toward optimizing your marketing efforts and ensuring that your customer acquisition strategies are effective and sustainable.

Now that you understand Customer Acquisition Cost, let's explore why calculating it is important for your business.

Why is Calculating CAC Important?

Calculating CAC is vital for several reasons:

- Budget Allocation: Knowing your CAC allows you to distribute your marketing budget more effectively. By identifying which channels yield the best return on investment, you can focus your resources on the most profitable strategies. For example, understanding which paid media campaigns are most cost-effective helps optimize your spending.

- Profitability Analysis: Comparing CAC with customer lifetime value (CLV) helps you assess the long-term profitability of your acquisition efforts. If your CAC exceeds your CLV, it indicates that you're spending too much to acquire each customer, which can jeopardize your business's financial health.

- Strategic Planning: Understanding CAC aids in setting realistic growth targets and developing sustainable marketing strategies. It ensures that your business can scale without overspending on customer acquisition, maintaining a healthy balance between growth and profitability.

- Performance Measurement: Tracking CAC over time allows you to measure the effectiveness of your marketing campaigns. It helps you identify trends, assess the impact of different strategies, and make necessary adjustments to improve your acquisition efforts. Tools like real-time analytics can provide valuable insights into your CAC trends.

By monitoring your CAC closely, you ensure that your marketing efforts are effective and sustainable, contributing to your business's overall growth and success.

With the importance of CAC clear, here are the steps you need to follow to calculate it accurately.

Steps to Calculate True Customer Acquisition Cost

Calculating your true CAC involves a series of steps to ensure accuracy and comprehensiveness:

- Define the Time Period: Determine the timeframe for which you want to calculate CAC, such as monthly, quarterly, or annually. This helps in tracking changes and trends over specific periods.

- Calculate Total Marketing and Sales Expenses: Add up all costs associated with marketing and sales during the chosen period.

- Determine the Number of New Customers Acquired: Count the total number of new customers gained during the same period. Ensure that the data is accurate to avoid skewed CAC calculations.

- Apply the CAC Formula:

CAC=Number of New Customers Acquired / Total Marketing and Sales Expenses - Analyze the Results: Compare your CAC against industry benchmarks and your customer lifetime value (CLV) to evaluate the effectiveness of your acquisition strategies.

- Refine Your Strategies: Use the insights gained from your CAC analysis to optimize your marketing efforts, reduce costs, and improve customer acquisition efficiency. Additionally, consider performance optimization techniques to enhance the efficiency of your campaigns.

Following these steps, you can accurately determine your CAC and make informed decisions to enhance your marketing performance.

To ensure your CAC calculation is complete, including the following components is essential.

Components to Include in CAC Calculation

To calculate CAC accurately, it's essential to include all relevant components of your marketing and sales expenses:

- Advertising Costs: This includes spending on online ads, social media promotions, search engine marketing, and any other paid advertising channels.Understanding the importance of meta tags and SEO can help optimize your advertising efforts.

- Salaries and Commissions: Account for the salaries of your marketing and sales teams, as well as any commissions or bonuses they receive.

- Software and Tools: Include costs for marketing automation tools, CRM systems, analytics platforms, and other software that supports your acquisition efforts.

- Content Creation: Factor in expenses related to creating content, such as blog posts, videos, graphics, and other marketing materials.

- Events and Sponsorships: If you participate in trade shows, webinars, or sponsor events, include these costs in your CAC calculation.

- Agency Fees: If you work with marketing or advertising agencies, include their fees as part of your total expenses.

- Miscellaneous Expenses: Any other costs directly related to acquiring customers, such as promotional giveaways or referral program incentives, should be included.

By incorporating all these components, you ensure that your CAC calculation is comprehensive and reflects the true cost of acquiring each customer. This thorough approach helps you identify areas where you can optimize spending and improve overall efficiency.

To illustrate how these concepts and strategies work in real-world scenarios, let's explore a few examples of businesses that successfully optimized their customer acquisition cost:

Examples and Scenarios

Example 1: E-Commerce Store Boosts CAC Efficiency

Imagine you run an online store selling eco-friendly home products. Over the course of a month, you spend $12,000 on sales and $18,000 on marketing efforts, including advertising, promotions, and other campaign costs. During this period, you acquire 5,000 new customers.

Calculation:

CAC=(12,000+18,000)/ 5,000

=30,000/5,000

=$6 per customer

While a CAC of $6 might seem reasonable, it's essential to compare it against the customer lifetime value (CLV) to ensure long-term profitability. If your CLV is significantly higher than your CAC, your acquisition efforts are sustainable. However, if the CLV is only slightly higher, you may need to optimize your marketing strategies to reduce CAC further.

Example 2: SaaS Company Optimizes CAC through Data Strategies

Imagine you run a Software as a Service (SaaS) company offering project management tools. Over six months, you spend $50,000 on sales and $100,000 on marketing campaigns to acquire 10,000 new customers.

Calculation:

CAC=(50,000+100,000) / 10,000

=150,000/10,000

= $15 per customer

A CAC of $15 might be acceptable if your CLV is high, say $150 per customer. However, if your CLV is closer to $100, you'll need to find ways to either increase the CLV or reduce the CAC. Implementing targeted marketing strategies and improving customer onboarding can help in lowering the CAC while maintaining or increasing the CLV.

After calculating CAC, here are strategies you can implement to optimize and reduce it.

How to Optimize and Lower CAC?

Optimizing and lowering your customer acquisition cost requires a strategic approach focusing on efficiency and effectiveness. Here are some proven strategies to help you achieve this:

- Enhance Conversion Rates:

- Optimize Conversion Funnels: Streamline your conversion funnels to reduce drop-offs and increase the percentage of leads that convert into customers. A smoother funnel leads to more conversions without additional marketing spend.

- A/B Testing: Continuously test different elements of your marketing campaigns to identify what resonates best with your audience. Small tweaks can lead to significant improvements in conversion rates.

- Improve Marketing Efficiency:

- Real-Time Analytics: Utilize real-time analytics to monitor your campaigns' performance. Immediate insights allow you to make swift adjustments, ensuring your marketing efforts remain effective and cost-efficient.

- Performance Optimization: Implement performance optimization techniques to enhance your website’s speed and user experience. A faster website can lead to higher conversion rates and lower CAC.

- Leverage Multi-Touch Attribution:

- Understand Customer Journeys: Use multi-touch attribution to understand how different marketing channels contribute to conversions. This understanding helps you allocate your budget more effectively, focusing on channels that drive the most value.

- Optimize Channel Mix: Based on your attribution analysis, adjust your marketing mix to prioritize high-performing channels, thereby reducing wasteful spending and lowering CAC.

- Utilize First-Party Data Effectively:

- Personalized Marketing: Use first-party data to create personalized marketing campaigns that resonate with your target audience. Personalized efforts tend to have higher engagement and conversion rates, reducing CAC.

- Data Segmentation: Segment your audience based on behavior, preferences, and demographics. Targeted campaigns are more efficient and cost-effective, leading to a lower CAC.

- Reduce Churn Rate:

- Improve Customer Retention: Focus on retaining existing customers by providing excellent customer service and engaging post-purchase experiences. Lowering your churn rate increases the customer lifetime value (CLV), making your CAC more sustainable.

- Engagement Strategies: Implement strategies to keep your customers engaged, such as loyalty programs, regular updates, and personalized communication. Engaged customers are more likely to make repeat purchases and refer others, reducing the need for costly acquisition efforts.

- Optimize Advertising Spend:

- Targeted Advertising: Focus your advertising efforts on well-defined target audiences to increase relevance and reduce wasted spending. Tools like server-side tagging ensure accurate data collection and better targeting.

- Cost Per Click (CPC) and Cost Per Lead (CPL): Monitor and optimize your CPC and CPL to ensure you get the most out of your advertising budget. Lowering these costs directly contributes to a reduced CAC.

Implementing these strategies can effectively optimize your marketing efforts, improve conversion rates, and ultimately lower your customer acquisition cost. These approaches not only enhance the efficiency of your campaigns but also contribute to sustainable business growth.

Conclusion

Accurately calculating and optimizing your customer acquisition cost (CAC) is essential for your business's success and sustainability. By understanding the components of CAC, navigating the challenges of a cookieless environment, and implementing effective strategies, you can ensure that your marketing efforts are both efficient and profitable.

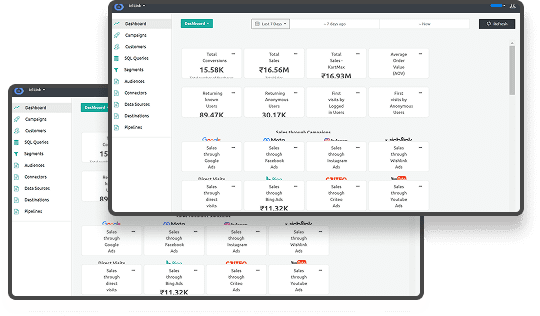

With Ingest Labs, you can access comprehensive tools and expertise that streamline your data collection, ensure compliance with privacy regulations, and provide valuable insights to optimize your marketing strategies. Whether you're running a paid media campaign, managing an e-commerce store, or overseeing an advertising agency, mastering your CAC with Ingest Labs' support will significantly enhance your growth trajectory.

Ready to take control of your customer acquisition cost and optimize your marketing strategies? Contact Ingest Labs today to learn how our comprehensive tag management and data solutions can help you streamline your data processes, ensure compliance, and achieve sustainable growth. Let us help you unlock the full potential of your marketing efforts and drive your business forward.